The detection of the rapid rise in USTreasury Bonds in the Belgium official central bank account has aroused broad and deep suspicions. Finally an open sore is visible that cannot be explained away easily. It first appeared a couple months ago. The initial knee-jerk reaction was that the USFed was colluding with the Euro Central Bank to hide heavy bond monetized purchases in New York, in effect demonstrating the Jackass point that the QE volume was huge, that the Bernanke and Yellen Fed were astute liars using deception. Next the evidence pointed to Russia having embarked on a significant dump of USTBonds using the proxy of EuroClear. It all made so much sense, the Russian account having declined in roughly the same volume as the Belgium account rose. Be sure to know that tiny Belgium has a rather notable current account deficit, no surplus funds to invest. Belgium has a GDP of $480 billion, the bulge fast approaching the size of their entire economy. Their chief export is tied closely to the hot air emanating from the EU Commission and Parliament, neither body possessing a scintilla of global integrity.

The question must be raised whether a hidden party has joined Russia in the dumping process. It could be that an angry Saudi Arabia has decided to discharge large tracts of USTBonds, or maybe Iran in a new financial war flank attack. Perhaps even China, using its Hong Kong window, has a reverse flow with Gold bullion entering and USTBonds exiting in payment. The Dollar empire has been in a middle stage of collapse with QE3 blessed and the Taper a mere fiction, sustained by creative lies. Clearly, the Belgium Bulge indicates a late stage of collapse. The game is fast changing, using big hidden channels in the monetary war. Motives are easy to identify. Russia is complying with the sanctions, removing funds in the face of frozen accounts and obstructed channels. The Saudis are another newly designated public enemy of the United States, which always prefers to maintain a list of enemy states to keep the fascist war machine humming. The Saudis might be discharging vast tracts of USTBonds after learning that the London bankers stealing their Gold.

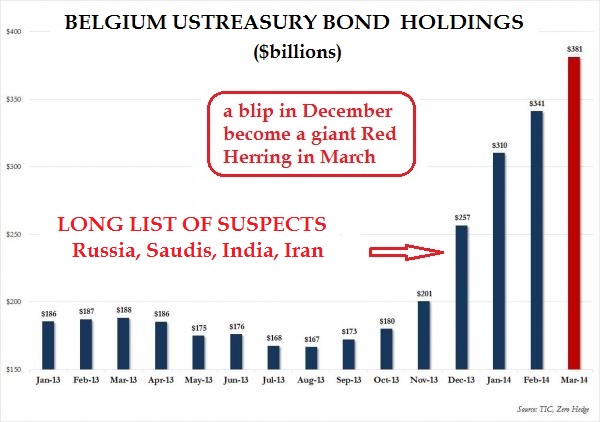

The latest pressures with Credit Suisse and even BNP Paribas to admit guilt has an odor about it. The USGovt is forcing merger with UBS and Societe Generale respectively, likely to enable easier Saudi gold account pilferage, a US fascist specialty. The ultimate vengeance by Saudi will be divestiture of USTBonds and full abandonment of the USDollar, followed by complete adoption of the Chinese Yuan and protectorate role. The Saudis soon will no longer have a conformity to the USDollar linkage to oil sales. The entire OPEC bloc will follow in a devastating blow to the USDollar. Later the final blow from that region of the world would be the formation and launch of the gold-backed Gulf Dinar. These steps would all be seen as declaration of war against US interests (common term used). The death of the Petro-Dollar might have a Saudi imprint in Belgium. Notice the Belgium Bulge Billboard, the beginning of their USTBond holding rise in November 2013 and unmistakably in December 2013 (at $257bn). It is a giant Red Herring in March at $381bn. When it surpasses half a $trillion, perhaps it will be a daily point of controversial debate.

Lies, propaganda, and outright deception are the game played. Just heard word from a Hat Trick Letter client from Belgium. He passed on the following. Herman Van Rompuy, president of the European counsel, stated in a weekly Belgian magazine his viewpoint regarding the Ukrainian rebellion. He wrote, "The revolt at Kiev in February 2014 came from the Ukrainian people themselves, sort of a phenomenon of civilization, not caused by a political project." Such drivel that avoids the entire Langley and Soros role with paid mercenaries to conduct the operation, even to relieve Kiev of its 33 tons of central bank gold in the wee hours of the night under cover of darkness, using masks, and telling the airport tower to back off. Expect Van Rompuy to be on the defensive soon, even ousted. These guys on the EU helm are dirty. When President of Portugal, EU honcho Barraso enabled the removal of over 60% of the Portuguese central bank gold supply. These guys are dirty and work for the fascist cabal.

PLAIN VANILLA INTERPRETATION

The backside decline elsewhere across major central banks has attracted bad attention. The world is dumping USGovt debt, as they reduce USTBonds held in portfolios in both official accounts and corporate accounts. Ridding themselves altogether of the toxic bonds will require years and a likely global conference on debt restructure. Recall the Jackass 2008 forecast of USGovt debt default. A major hubbub began last March, two months ago, when total USFed custody holdings plunged by a record $104.5 billion. Attention was raised, bad attention, unwanted attention, a new nasty wrinkle in the global monetary war over control of money and creation of false wealth. The Treasury Investment Capital report indicated that Russia indeed dumped a record $26 billion in January, equal to 20% of all of its holdings, bringing its post-March total to just over $100 billion. The Belgians and Russians each have red herrings of opposite type. Their account has not been lower since the Lehman crisis. The Belgium site enjoyed a ripe $40bn rise in USTreasurys held, hardly from the country's non-existent trade surplus. Once again, the decline in Russian account is offset by rise in Belgian account. The intrepid Zero Hedge journal has been covering the story extensively, as always on the leading edge. Russia is complying with the sanctions theme, and probably continued past the March reading in still high volume. However, there is much more to the Belgium Bulge story.

GRAY AREA INTERPRETATION

To be sure, one must view the Bulge with a perspective in battle terms. No doubt, Belgium is taking bonds being privately placed, with some measure of orchestrated movement by the USFed, Wall Street, and London banks. We are seeing the Russian dumping through secondaries and proxies, with a possible usage of swap market in reinforcement. Overt dumping would be the equivalent of a declaration of war. The usage of secondaries enables some quasi deniability. World monetary war has taken a quantum jump up in intensity and danger. More movement is seen in recent TIC Reports, with various nations like Luxembourg, Switzerland, and Caribbean Centers pushing up on USTBond holdings. Many are USFed partners lending a hand using hidey holes to conceal QE hidden volumes.

JPMorgan & Goldman Sachs are the duo most active in hidden dark pools, often using the Exchange Stabilization Fund to clean up the mess and hide the trails. A long shot is that the Dastardly Duo might have a problem with (say) $100bn in USTBonds stuffed on their balance sheets. They might wish to conceal the cancerous bloat, possibly supporting their own Interest Rate Swap position. The swaps have a floating element but also a stake in the ground. To be sure, no entity could step in to buy them without another round of QE, as in QE4. The focus by the alternative media is on the buyer's identity, instead of what is the purpose of these USTBonds being held at the EuroClear in Belgium. The simple hypothesis stated in the previous story does not pass the deeper reality tests. A different purpose is involved, and the size meant that it was a giant player, like a sovereign entity.

We could be seeing some surfacing evidence of the gigantic London Whale losses, estimated by the Voice in summer 2012 to be in excess of $100 billion. The Jackass reported on the event two years ago. Perhaps part of the Belgium Bulge is their position gone out of control, mixed in with the Russian borscht soup. They have strong motive to conceal the true gigantic extent of London Whale losses through the JPM CIO investment office. The scoop in London is that at least two banker murders were to cover up the London Whale revelations on staggering loss volumes. Some Swiss insurance firm murders might be interwoven, if insurance came in the form of Credit Default Swap contracts. The ties from Swiss RE to JPMorgan are clear, as $1 billion letters of credit between the two giant firms leave trails. As footnote, both firms have a firm hand in the 911 event and its scummy financial background, like a third building full of data being demolished in the World Trade Center complex.

Another factor must be considered as part of the Belgium Bulge. A new London source (also a Hat Trick Letter client) has noticed an anomaly. The word has that Russia, China, Japan, Taiwan, and Ireland have cut deals to move USTreasury holdings to Belgium via the EuroClear. The finger of suspicion comes from thorough digestion of the TIC Reports and other USTreasury data. Perhaps some powerful combination of factors such as risk of sanctions, freezing their assets, and perhaps the inability to move dollars from international jurisdictions commencing around July. The Basel III restrictions might cause some unintended backlash and bulges. Individual designated mainstream nations are stepping forward to serve in proxy roles. The complexity of USTreasury holdings and their location and also reliability of data just muddies the waters even more. So Belgium might be a repository for funds at risk, from nations dealing with expected obstructions. One should never lose sight of the fact that the USTreasury Bond complex, tied at the hip with chronic annual $1 trillion USGovt deficits, funding the endless war campaigns, with all its bond monetization by the USFed to sustain its bubble pressures, with all the major central bank support to keep it afloat, with all its reserves held in foreign bank systems, together with the vast array of hidden derivative contracts, is the biggest asset bubble in the history of mankind. Its collapse will have numerous confusing symptoms, and be explained by as many lies.

Nothing is definitive, but many are the potential sources, indicative of broadening crisis. Thus the Belgium Bulge. A basic query by the observers. One must ask why the tens of $billions in USTreasury sales were not executed and cleared via the USFed's official National Book Entry System (NBES), designed specifically for its custodial customers. Instead, the sales were done through the EuroClear securities clearing system, which is based in Brussels Belgium. Bear in mind that the Deutsche Borse has its own parallel ClearStream house for potential proxy abuse.

BRICS NATIONS SOURCE GOLD BULLION

Consider a very different story, a hypothesis in jump shift that seems as credible as disruptive. The Belgium Bulge Billboard might instead show posted USTreasuy Bonds as collateral to meet a gigantic margin call for a gigantic gold contract position, possibly to set up the gigantic vaults for BRICS central bank gold reserves, functioning in support of the new Gold Trade Standard. The transition might be bumpy. The position might be mixed with redemption demands for reserves held in Intl Monetary Fund accounts, which players want dissolved. After all the IMF is defunct, its main activity seen over the charred Greek and Ukraine fields. Furthermore, the Belgium Bulge might mean that London sourcing has ended, almost zero gold. The Jackass has been warning for months that true mayhem will come when the Chinese are frustrated in sourcing further London gold. The evidence might be the switch from hidden London sourcing to open market indications such as the bulge.

History might be repeating itself with a financial warfront Battle of the Belgium Bulge, a pincer movement to capture Western gold and form the Anti-USD Central Bank. Further parallel is the battle is against Fascism ironically. We might be seeing the birth of the BRICS Gold Central Bank, in a grand titanic struggle to source its gold for vault storage, decentralized as expected. The ugly twist is the the US-UK team are the fascist axis. The party behind the Belgium Bulge might be facing margin calls as the Gold price slides. Instead of booking losses and suffering liquidation of their leveraged position, they increase their margin collateral in the form of USTreasury Bonds. The party is heavily long some paper Gold contract or even possibly in combination with the GLD fund shares. A normal investor or a hedge fund would certainly not have the firepower in terms of ability to sit on a 10 to 20% loss and to maintain a position many $billions underwater. Therefore, the Belgium Bulge means a big Sovereign Type Entity is in the Game, who refuses to take losses but instead continues to post collateral with a goal toward taking Gold Delivery. Look for more margin collateral to be posted in the next monthly reporting disclosure, and the controversial story to ramp up. The risk to the London & New York & EU bank cabal, is that this large player entity demands physical gold, works toward delivery, and pays at the original $1300-1500 price on the contract, where the posted USTBond collateral is kept by the gold exchange.

The Gold Trade Standard might be born amidst a legal challenge to deliver the gold on the biggest delivery the world has ever seen, with contracts on display, with Interpol officers at the table, with collateral verified, with a caravan a mile long of armored trucks awaiting, even with Triad lieutenants in attendance for enforcement. The remainder of the contract sale will be settled in USTreasurys, along with the bulk gold delivery. The sovereign players will not be shaken. They want their gold, likely to form an initial core to the BRICS Central Bank.

The entire hypothesis makes great sense, ties pieces together, and reflects the struggle of forming the alternative system which ushers in the Gold Trade Standard. The King Dollar is being deposed, and the Belgium Bulge could indicate the dismissal and derailing of the global reserve currency. The Belgium Bulge Billboard is posted USTreasury Bonds as collateral to meet a gigantic margin call. The players are not identified, but probably a combination team of Russia, China, India, Saudi Arabia, possibly even Iran and Japan. They might be working to preserve a gigantic gold position to set up the BRICS Central Bank for Gold reserves. The gold position is clearly a group of sovereigns (meaning nations and their finance ministers or wealth fund mgmt team). They might not choose to conceal their activity much longer. JPMorgan could conceal the activity easily within the bowels of the Exch Stabilization Fund. The BRICS nations might wish to use the glaring billboard neon lights in the TIC Report as publicity, with every intention of making the battle known to analysts and experts in the banking industry, the entire banking industry watching like in stadium seats. The Jackass is not an insider, but the Hat Trick Letter team includes a few with deep insight, some insider information, and profound savvy.

The Belgium Bulge might be evidence that the major London Gold Drain might be almost finished, replaced by Paper Gold sourcing done more in the open. Therefore conclude the Belgium Bulge Billboard is a Call To Arms for the Eastern nations to fortify a gold core. Credit goes to EuroRaj, the brilliant intrepid London bank analyst who consistently thinks outside the box, and identifies the key elements in the Paradigm Shift with insights of troop movements and supply chain caravans during the global financial war. He pieced this theory together to formulate the highly credible hypothesis. My role was to digest it, elaborate upon it, and put it to print in the promulgation process. It lacks some details, as one would expect, but still indicates a mammoth shift. The roots of EuroRaj come from India, Turkey, Iran. His work experience includes London. He wrote a few weeks ago that more is to this story besides simply Russia dumping USTreasurys.

NAPKIN SCRIBBLES INDICATE HUGE VOLUME

Try some napkin scribbles. To get the math straight with proper perspective, $1 billion funds roughly 25 tons of gold. So $400bn funds 1000 tons of gold, a critical mass for the BRICS central bank. The Belgium Bulge could indicate a precious pregnancy and birth soon of a 1000-ton golden baby! It is more complicated, and potentially much larger a story. If leverage is being used, typically seen as 25:1 or 30:1, then the portion of the bulge devoted to the BRICS Gold sourcing project could be at least 8500 tons of Gold bullion, equal to what Fort Knox had before the Clinton-Rubin gangsters stole it in full view, under cover of the Gold Carry Trade with near 0% lease rates, right under our noses.

More EuroRaj rationale came with some conjecture in his line of deeper thinking. The USFed and JPMorgan agent are too skilled at concealment. Therefore possibly conclude that the entity does not object to the billboard in Brussels, and actually prefers its visibility from afar. We might be seeing a time bomb where some party is controlling against JPMorgan, in the wake of Chinese conglomerate purchasing its South Manhattan headquarter complex and vault. Consider a small twist to this scheme too. The sovereigns (Russia, China, India, Saudi, Japan) might have approached the Intl Monetary Fund or Bank For Intl Settlements in confrontation to demand a conversion of SDR pledged capital into physical Gold. If so, then the IMF/BIS then in turn would have gone to JPMorgan and demanded from them physical Gold to be delivered against the Special Drawing Rights on pledged account. It is a basket of USDollar, Euro, JapYen, British Pound, but primarily USD. The IMF might be dissolving, with evidence the Belgium Bulge itself.

Recall that the BRICS have already announced plans to set up a Development Bank by July with $100 billion in capital, with much preliminary ground work already completed. They also have kicked the IMF to the curb of irrelevance, the exclamation point being the absent USGovt funding contribution. The Jackass suspects the official BRICS Development Bank is to be a hidden gold central bank. The USTBonds held at the EuroClear are collateral meant for a physical gold trade. Notice the BRICS Devmt Bank is slowly being called the BRICS Bank in the press. Eventually perhaps the BRICS Gold Central Bank, used to convert the toxic USTBonds into Gold bullion. Come one, come all, as the toxic EuroBonds, toxic UKGilts, and toxic JapGovtBonds will all be converted to Gold. They are toxic for three simple reasons: years of near 0% money, years of unsterilized bond monetization, years of backdoor Wall Street bailouts.

THE RISE OF THE GERMAN HUB

The Jackass sees the Belgium Bulge as a repeat of history, and an unfolding of events toward the development and construction of the Eurasian Trade Zone. A key element of the trade zone will be the integration of Frankfurt Germany as a RMB trading hub. Refer to the Chinese Yuan currency, aka Renminbi. Dozens of significant deals of size are in the works, in progress. The nation of Germany has 3000 firms doing business in Russia. The nation of Germany stands alongside Japan as the biggest foreign commercial partners in China. Anticipate Frankfurt to take on the financial hub role as partners to Russia & China, not London. A second clearing house exists, whose presence indicates much bigger German role in Eurasian Trade Zone matters. In addition to EuroClear there is the German ClearStream. The German investment bankers are not only spearheading the internationalization of the RMB but also moving fast on it. The nation of Germany will be a major conduit for technology transfer. These are two large clearing houses (EuroClear & ClearStream) that can also be custodial chambers. Many more developments are in progress toward the Eurasian Trade Zone, the role of Germany teaming with Turkey in a key role that will take the flatfooted West totally off guard.

Watch Frankfurt and Turkey team up to work on intermediary Gold provision for trade settlement and for BRICS central bank provision. Both Germany and Turkey are important swing states. They could work together in the intermediary gold function and fortify the entire Eurasian Trade Zone. Already Hong Kong is the true London of Asia. What incredible impact it would have if Germany and Turkey solidify the Gold Ramparts to the Gold Trade Standard. As footnote, the Ramstein NATO base in Germany, and the Ircirlik NATO base in Turkey, could work on the gold transfer logistics. Moving away from heroin for USMilitary distribution across all the NATO bases, and moving toward Gold bullion in Eurasian Trade Zone distribution would be a very positive progression.

The Chinese Yuan trade is setting up its mutually cooperative designated banks much like on the bare wild frontier. The Yuan Swap Facilities are much like frontier trading posts. It looks like Frankfurt is being set up to give some serious competition to London, as it could become the principal Western financial hub for Eurasia. The Voice directly confirmed this development plan for the German financial center city, the final twist cited by EuroRaj with a stack of projects queued up. These many points, factors, and angles are analyzed in more depth in the Hat Trick Letter reports.

The BRICS nations in the Jackass view are acting in coordinated fashion. These players are explicitly telegraphing a message to those who knew how to read it. The Eastern group of sovereign nations is making a global billboard statement, a Call to Arms in the Global Monetary War, in the Global Gold War. They wish to formulate the critical mass required to launch a New Gold Trade Standard. They must assemble the gold reserves, a very complex task when such great volume approaching 10,000 tons is desired (as a mere start). They are busily sourcing the vast BRICS Gold Central Bank, which will fortify the Gold Trade Notes used as letters of credit. It is all coming together, and even the gold community struggles to read the signals. It is important never to take the stories at face value. If the dots connect, even in astounding ways, it pays to follow the pattern, to step back, and see the picture clearly. The BRICS nations and their Associates are boldly sourcing thousands of tons of Gold!!

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

"Not only have I seen many of the things you talk about in the public arena come to pass, but I have seen many of the things you say repeated three months later by the other analysts. Congratulations!"

(MannyM in England)

"Your Hat Trick Letters reports are like the food I like to eat, nutrient dense, high fibre, many rich single and combined flavours, unadulterated, very colourful, (especially your turn of phrase, unique), tidbits from all over the world. I always look forward to them too, a very satisfying feed/read, with original connections between ingredients and forward culinary thinking leading to new dishes from heretofore un-imagined recipes that are obvious from hindsight and take some time to chew and digest."

(Nick from Australia)

"Jim Willie is a gift to our age who is the only clear voice sounding the alarm of the extreme financial crisis facing the Western nations. He has unique skills of unbiased analysis with synthesis of information from his valuable sources. Since 2007, he has made over 17 correct forecast calls, each at least a year ahead of time. If you read his work or listen to his interviews, you will see what has been happening, know what to expect, and know what to do."

(Charles in New Mexico)

"A Paradigm change is occurring for sure. Your reports and analysis are historic documents, allowing future generations to have an accurate account of what and why things went wrong so badly. There is no other written account that strings things along on the timeline, as your writings do. I share them with a handful of incredibly influential people whose decisions are greatly impacted by having the information in the Jackass format. The system is coming apart on such a mega scale that it is difficult to wrap one's head around where all this will end. But then, the universe strives for equilibrium and all will eventually balance out."

(The Voice, a European gold trader source)

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com. For personal questions about subscriptions, contact him at JimWillieCB@aol.com