Excerpt from this week's: Technical Scoop: Rate News, Copper Lead, Magnificent Falter

Source: www.stockcharts.com

Gold hit a record high this week following the Fed’s hold-the-line announcement on interest rates. The Fed also suggested up to three rate cuts in 2024. This sparked gold to rally to new all-time highs at $2,225 as we cleared $2,200 for the first time. But, like what happened back in December, it was a spike high followed by a sell-off. After the mixed signals of the BOJ hiking rates while the SNB cut rates, fears grew again that the Fed might not cut as fast as some want. Better than expected manufacturing numbers (as we noted earlier) would do that.

Gold corrected further on Friday and then closed on the week down just under 0.1%. Silver didn’t fare as well, losing 2.1%, while platinum fell a sharp 4.8%. Palladium also dropped off 8.4% while copper was better, falling only 2.8%. The gold stock indices also fell with the Gold Bugs Index (HUI) off 0.9% and the TSX Gold Index (TGD) down 0.2%. Not a great week. The commercial COT wasn’t helping either as it came in at 28% as it continues to be under 30%. As we noted, the US$ Index jumped on the expectations of higher rates for longer.

The expectation here is that, following this correction, gold will eventually take out $2,200 with minimum targets of $2,300 and secondary targets up to $2,500. However, as we saw after the early December spike over $2,100, gold followed a pattern of ups and downs into February before the current upward thrust got underway. The advance appears to have unfolded in five waves to the top at $2,225. That suggests that after another correction we should advance once again on a strong up wave. Admittedly, this could last into late April or even into May before we turn up once again.

Gold should have support down to $2,140, but under that level we could fall to $2,100 and trendline support. The 50-day MA is down at $2,075. Under that level we’d have more concern that any correction could be deeper and longer.

Of all the central banks, the Fed is the only one that is not signaling a potential immediate cut in rates. The BOJ was hiking rates because of an uptick in inflation in Japan. They also ended a long period of negative interest rates. But with mixed signals coming from the Fed, traders took it as a signal that the Fed may hold the line on interest rate cuts for now. That helped push the US$ Index higher and gold lower.

A corrective period is underway, but it’s not the end of the current gold rally. As noted, we prefer we stay above $2,100 but would not want to see gold go under $2,075.

Source: www.stockcharts.com

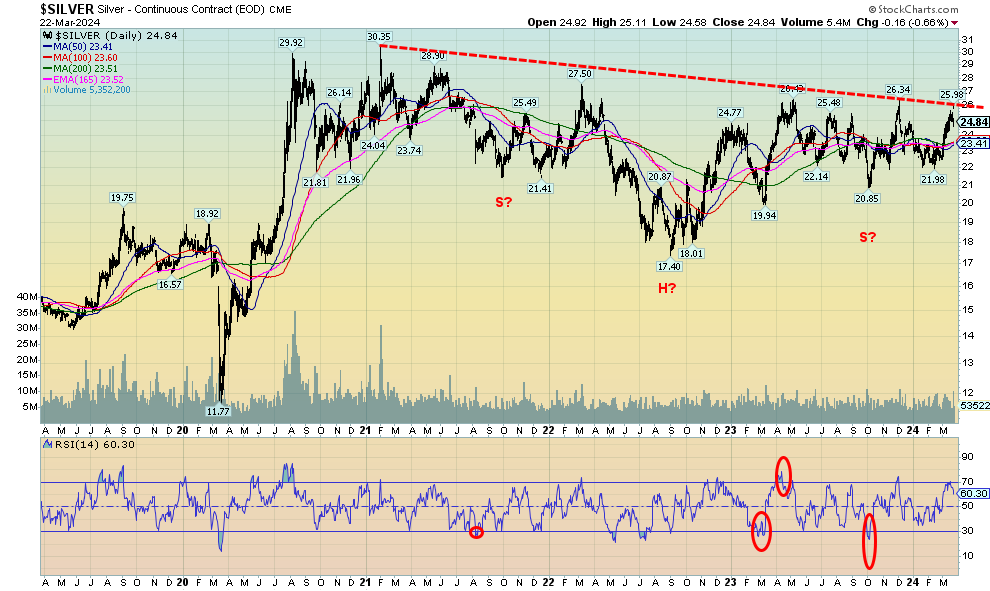

Silver teased us with a breakout above $26, then faded along with gold, closing the week down 2.1% and back under $25. Resistance zones continue to act as a stopper. The high was $25.98. Nonetheless, the potentially compelling multi-year head and shoulders pattern keeps us awaiting a breakout above $26 with confirmation only to come above $27.50. Targets could then be up to around $39. We do have good support down to $23.50, but under $23 silver would look lower. A break under $21 would suggest the potential head and shoulders pattern is breaking down. The commercial COT isn’t helping us as it has fallen to 28% for silver, the same as gold. We prefer to see it over 40%.

Read the entire report: Technical Scoop: Rate News, Copper Lead, Magnificent Falter

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.